What is White Labeling? Launch Your Own Software Platform

White labeling is a versatile way to sell high‑quality products or services under your own brand without building them from scratch. A provider creates the solution, you rebrand it, set pricing, and own the client relationship. The payoff is speed and focus so you can launch in days, cut development costs, and expand your offer (think analytics dashboards, chatbots, reporting, ecommerce) without new hires. Use white‑label software and services to add recurring revenue, test new niches with low risk, and upsell clients with bundled services. Done right, it strengthens your brand, improves margins, and gets you to market fast.

73% of businesses use white label to enter the market faster. The definition of "white label" comes from goods shipped with plain, blank white labels space meant for a retailer’s own branding. In software and services, it’s the same idea with a ready product delivered unbranded so a reseller can apply logo, name, colors, domain, and pricing.

Benefits of White Label for the Buyer

| Benefit | Description |

|---|---|

| Cost Efficiency | Cut upfront development, ongoing support and maintenance by reselling a proven platform, then reinvest savings into acquisition and retention. |

| Time Savings | Go live in days rather than months with a ready‑made stack, skipping build cycles and long QA sprints. |

| Enhanced Brand Reputation | Deliver a polished, fully branded experience that improves trust and perceived value. |

| Recurring Revenue | Package subscription plans and keep billing under your brand to build predictable MRR. |

| Scalability | Add clients and features without hiring a dev team or managing infrastructure. |

| Support & Security | Rely on the provider’s continuous updates, patches, and uptime SLAs. |

| Customization & Control | Align logos, colors, domains, and pricing with your positioning and margins. |

White‑label gives full branding control and the flexibility to package solutions that fit the market without taking on overhead. It strengthens brand perception and keeps the client relationship under the reseller’s domain. With the platform maintained by the provider, the buyer can focus on selling, onboarding, and growth instead of building from scratch.

Key Takeaways

-

White labeling lets you sell under an existing brand without building from scratch, cutting time-to-launch and spend.

-

White label enables faster go‑to‑market by shipping new services in days and staying ahead of competitors.

-

Customization matters: apply logos, colors, domains, and copy so the product feels native to the brand.

-

Focus on core work such as marketing, onboarding, and client success, while the provider handles hosting, updates, and support.

-

Choose partners carefully: look for responsive support, transparent pricing, clear SLAs, and flexible customization options.

-

Keep control of pricing and packaging to build predictable recurring revenue and own the client relationship.

-

Scale without extra hires: add clients and features as demand grows, without taking on infrastructure.

What’s in it for the White Label Provider?

White labeling isn’t a shortcut for resellers, it’s a channel business strategy for the manufacturer to grow faster with lower customer-acquisition cost, broader market coverage, and tighter product-market fit through partner feedback. By letting agencies, freelancers, and entrepreneurs own branding, market penetration and customer acquisition, white-label providers can concentrate on roadmap, reliability, and security while building predictable wholesale revenue streams.

Benefits of white label for the provider

| Benefit | Why it matters to the provider |

|---|---|

| Bigger distribution network | White-label partners open doors to niches, geographies, and micro‑segments a direct sales team can’t reach cost‑effectively, turning one platform into many branded offerings. This widens top‑of‑funnel without proportional headcount. |

| Lower Customer Acquisition Cost (CAC) and sales overhead | Resellers fund their own marketing and sales motions; vendors invest in product, APIs, and enablement instead of high‑touch acquisition, improving unit economics. |

| Faster market entry and geo expansion | Local partners bring language, compliance, and cultural fit, reducing time‑to‑revenue when entering new regions or verticals. |

| Verticalization through partners | Agencies and solo founders package the core product for specific industries (playbooks, templates, add‑ons), creating repeatable solutions the manufacturer couldn’t feasibly build for every niche. |

| Stronger product feedback | Resellers are power users close to end‑customer pain; their aggregated requests sharpen UX, integrations, and ROI stories, accelerating roadmap fit. |

| Economies of scale | One multi‑tenant platform serves many brands; as tenants grow, shared hosting, support, security, and compliance costs are amortized across the base, reducing per‑customer Cost of Goods Sold (COGS) and improving gross margin while the vendor maintains a single codebase. |

| Recurring wholesale revenue | Predictable white label partner subscriptions create stable ARR with clear renewal and upsell paths into seats, modules, or usage without the vendor running every deal end‑to‑end. |

| Clear Channel Segmentation | Providers can sell enterprise direct while white-label partners serve Small-to-Medium Businesses (SMB)/mid‑market under different brands and packaging, avoiding channel conflict while capturing more of the demand curve. |

| Ideal customer profile (ICP) clarity | Agencies, freelancers, and entrepreneurs reveal which micro‑segments convert, retain, and expand, sharpening the supplier’s ICP and enabling tighter messaging, pricing, and roadmap prioritization; this focus lowers CAC, reduces churn, without broad and unfocused campaigns. |

| Partners Driving Lifetime Value | Specialized resellers can add migration and in-depth onboarding services that help boosts customer adoption rate, reduce churn and increase customer Lifetime Value (LTV). |

Bottom line: a true win‑win happens when the manufacturer treats white label as a first‑class channel. By elevating resellers to the same strategic level as direct sales, providers enable them to drive adoption, deliver onboarding and migration services, and serve markets the core brand may not reach.

As a reseller, assess whether the provider is genuinely self‑aware and motivated to deliver these benefits—now and long‑term—or if “white label” is just a marketing gimmick to get sign‑ups without real partner focus.

White Label vs. Private Label

Both models let brands sell third‑party creations under their name; white label keeps the core product the same across resellers with specific branding changes, while private label offers greater control and exclusivity over the underlying product.

Physical (goods) private label

More suited towards physical goods, private label typically means a retailer partners with a manufacturer to produce exclusive items, think food, beauty, and apparel with custom specs, packaging, and margins tuned to the brand. These products look and feel native but are produced by a third party, enabling differentiation without owning factories.

Private Label Rights (PLR)

For digital assets, the private‑label concept appears as PLR, which grants extensive rights to edit, rebrand, and resell content. PLR spans e‑books, courses, templates, graphics, videos, and article libraries, and buyers can rewrite, reorganize, and expand the material to fit a niche. Unlike typical white label software often covering logos, colors, and copy blocks, PLR lets creators modify the core content, structure, and presentation to deliver a truly unique offer.

When to use white label or private label?

-

Use white label to enter a category fast with a proven core and minimal configuration.

-

Use private label providers to deliver exclusive products tailored to your brand, with control over specifications, packaging, and positioning for stronger differentiation.

-

Use PLR to craft differentiated, ownable digital products where messaging, curriculum, or creative direction drives value.

-

Combine both: white label software for delivery or tooling, PLR for brandable education, marketing assets, and lead magnets around the offer.

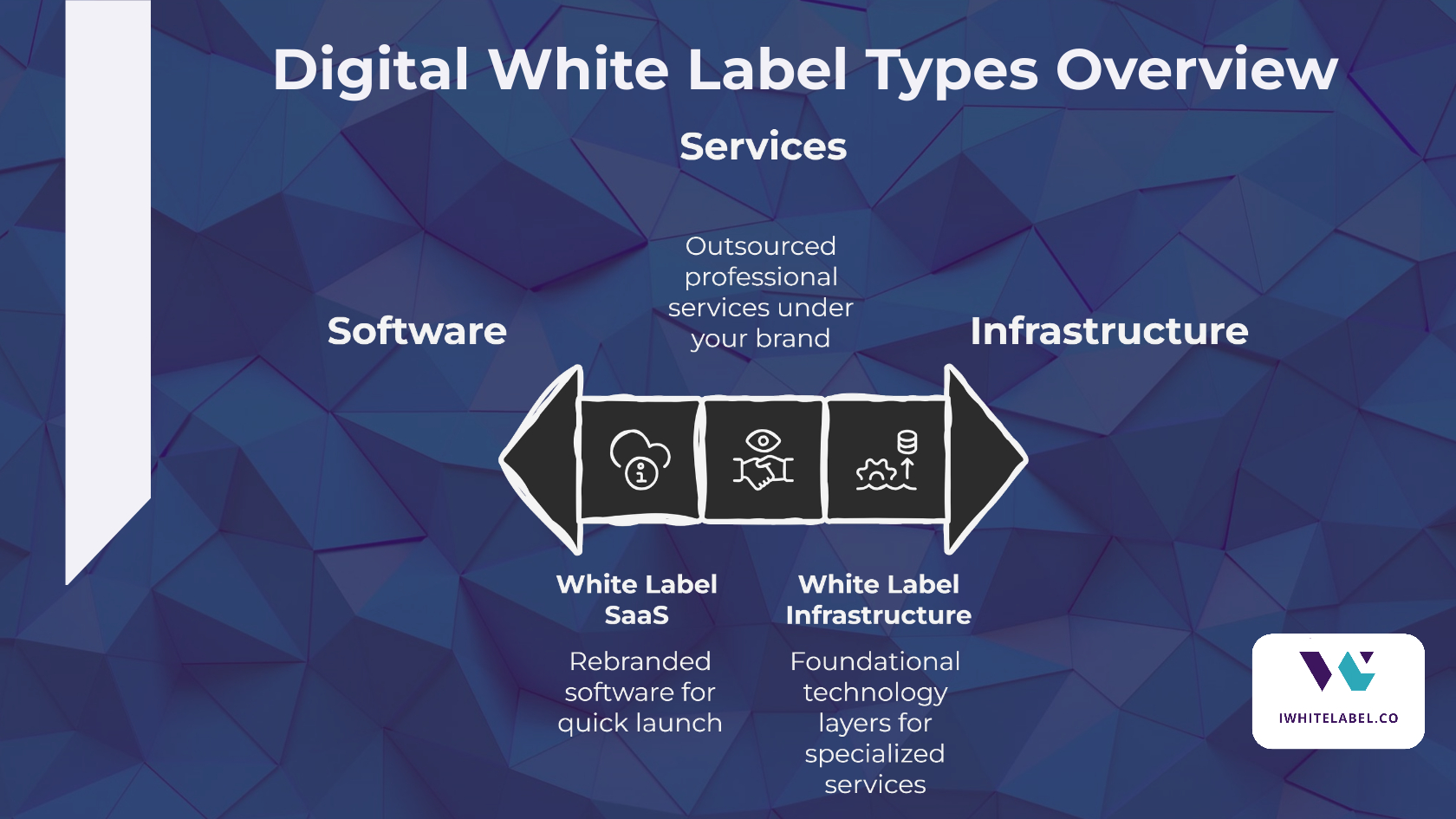

Digital White Label Types Overview

White label digital products and services come in various forms, each serving a unique role in helping businesses scale without building from scratch. While “white label SaaS” is the most common term used, this extends beyond just software apps to infrastructure layers and service delivery. Here’s a quick tour to understand the different types:

White Label SaaS or Software

Often used interchangeably with “white label software,” white label SaaS refers to a software product developed and hosted by one company that others can rebrand and resell under their own brand name. The software offers customizable options such as logos, colors, themes, and select features allowing resellers to tailor the experience to their brand while keeping the core product consistent across buyers.

This model lets agencies, entrepreneurs, and freelancers launch robust tools quickly without demanding in-house development or ongoing support and maintenance resources. The original provider handles hosting, updates, and tech support, so resellers can focus on sales and customer relationships.

Typical categories include:

-

CRM and sales enablement platforms

-

Marketing automation, email, and social media management tools

-

Analytics dashboards and client portals

-

Chat, booking, ecommerce, and helpdesk solutions

White Label Infrastructure

White-label extends beyond customer-facing apps to the foundational technology layers that power them. These often include:

-

Blockchain infrastructure for wallets, credential verification, and digital badges

-

Payment gateways, billing, and subscription processing powered by branded APIs

-

VoIP softphone systems and telephony infrastructure

-

Identity management, SSO, and data pipeline services

By white labeling infrastructure, companies can offer specialized services under their own domains with high scalability and control over critical back-end components.

White Label Services

Another important category is outsourcing professional services under your brand to fulfill client needs at scale, without expanding your internal team. Common white label services include:

-

SEO, PPC, and content production

-

Customer support, onboarding, and success management

-

Technical implementation like integrations, workflow automation, AI builds

-

Reporting, analytics reviews, and business consulting

This model lets firms maintain client relationships and margins while scaling operational capacity through trusted partners.

Some providers blend multiple white label models—pairing branded SaaS with embedded infrastructure and service layers—which strengthens their positioning and makes their offers stickier across use cases.

Others market SDK‐based white label solutions with professional services to accelerate deployments.

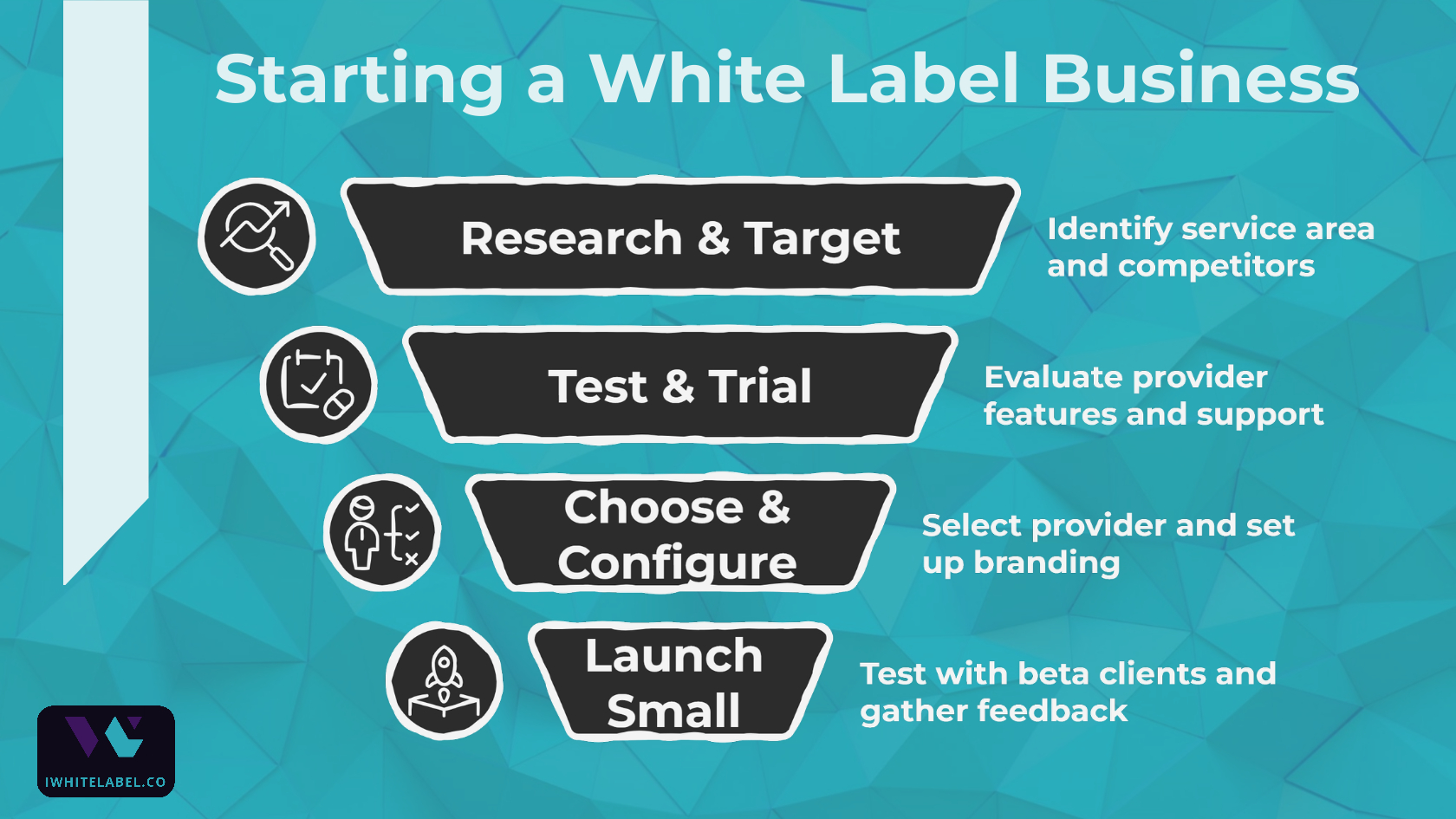

Starting a White Label Business: Your Action Guide

White labeling doesn't need to be complicated, the idea is to start simple, test quickly, and maximize this scalable business model. Here's a practical guide that works for marketing agencies, entrepreneurs, and freelancers looking to add new revenue streams fast.

Quick start checklist

Week 1: Research and target

-

Pick one service area your clients already ask about

-

Check 3-5 competitors to see what they charge

-

List your "must-have" features vs "nice-to-have"

-

Assess the provider's financial stability and roadmap alignment

-

Set a realistic monthly revenue goal or break even within 12 months

Week 2: Test and trial

-

Sign up for 2-3 free trials from top contenders

-

Test the core features you'd sell most often

-

See how easy it is to add your logo, branding and other relevant customizations, if applicable setup sub accounts

-

Check if their support actually responds timely (24 hours or based on their guarantees)

Week 3: Choose and configure

-

Pick your winner based on ease-of-use, scalable depth and margins

-

Set up branding (logo, colors, domain)

-

Set up user roles and access permissions

-

Create simple pricing packages (starter, pro, premium)

-

Write one-page sales sheet explaining the benefits and connect your payment systems

Week 4: Launch small

-

Customize dashboards and user interfaces

-

Set up integrations with existing tools and workflows

-

Configure reporting and analytics features

-

Select 2-3 trusted clients for beta testing

-

Get feedback and fix any obvious issues

-

Create basic onboarding process

-

Plan your bigger launch for next month

Key Things to Evaluate as a Reseller

Provider basics

✅ Do check:

-

Can you easily remove their branding and add yours or your clients?

-

Do they respond to support tickets within 24 hours and have uptime guarantees?

-

Are there hidden fees beyond the monthly cost?

-

Can you set your own prices and keep good margins?

-

Ask about their client success metrics and churn rates

-

Understand their product roadmap and development priorities

-

Assess their financial stability and long-term viability

❌ Red flags:

-

Complex setup that takes weeks to configure

-

No chat system or real human support

-

Pricing that changes based on your success

-

Can't white label key areas like invoices, reports, back-end interface and client emails

Financial reality check

Simple questions to ask:

-

What's my monthly cost vs what I can charge clients?

-

How many clients do I need to break even?

-

What happens if I want to quit, am I stuck?

-

Are there setup fees or long-term contracts I can't escape?

-

Plan for additional costs like custom development or premium support

The "works for my business" test

✅ Good signs:

-

You can explain the value in one sentence

-

Setup takes hours, not weeks

-

Your existing clients would actually pay for this

-

You can start selling within 2 weeks

-

You can add your own services or features to make it unique

-

Setup takes hours, not weeks with up-to-date tutorials

-

Industry compliance is handled or matches what you need

-

Customization levels let you configure what matters most

❌ Warning signs:

-

Requires major changes to how you work

-

Needs technical skills you don't have

-

Solves problems your clients don't have

-

Takes months or years to see any revenue

Evaluation shortcuts for busy people

Instead of complex scoring systems, ask these deal-breaker questions:

Can I be profitable?

Monthly cost + time to market vs realistic client pricing = positive or negative?

Will my clients buy it?

Does this solve a real problem they complain about and would pay to fix?

Can I actually deliver it?

Do I understand it well enough to sell confidently and support clients?

Can I make it unique?

Can I bundle this with my existing services, add custom training, or create packages that competitors can't easily copy?

Does it meet compliance needs?

If you serve healthcare, finance, or EU clients, does the platform handle GDPR, HIPAA, or industry requirements you can't ignore?

How much can I customize?

Can you configure the features your clients need most, or are you stuck with a one-size-fits-all approach that doesn't match your market?

What if it doesn't work?

Can I get out without major losses or making your existing clients unsatisfied?

Differentiation tip: The best businesses combine white label tools with other tools or their own expertise like adding monthly strategy calls, custom reporting, or industry-specific templates. This makes your offer harder to replicate and justifies premium pricing.

What Providers Need to Check in White Label Partnerships

To build a thriving white-label channel, providers must balance partner support with product focus. Here’s what to review before and after bringing on resellers:

| Category | What to Review | Why It Matters |

|---|---|---|

| Partner program setup | Define partner roles, and as you mature offer a onboarding portal, and supply support guides | Speeds onboarding, cuts support questions and makes it easy for partners to sell |

| Roadmap transparency | Maintain a public roadmap and align updates with partner-driven revenue | Keeps the product focused and avoids scattered feature requests |

| Financial health | Track customer acquisition cost, lifetime value, payback period, and retention rates | Ensures wholesale pricing stays profitable over time |

| Cost management | Monitor per-partner usage, set quotas or storage caps, and enforce fair-use policies | Protects your margins and unknowns as reseller traffic grows |

Focusing on these areas keeps your white label offerings sharp, scalable, and mutually rewarding.

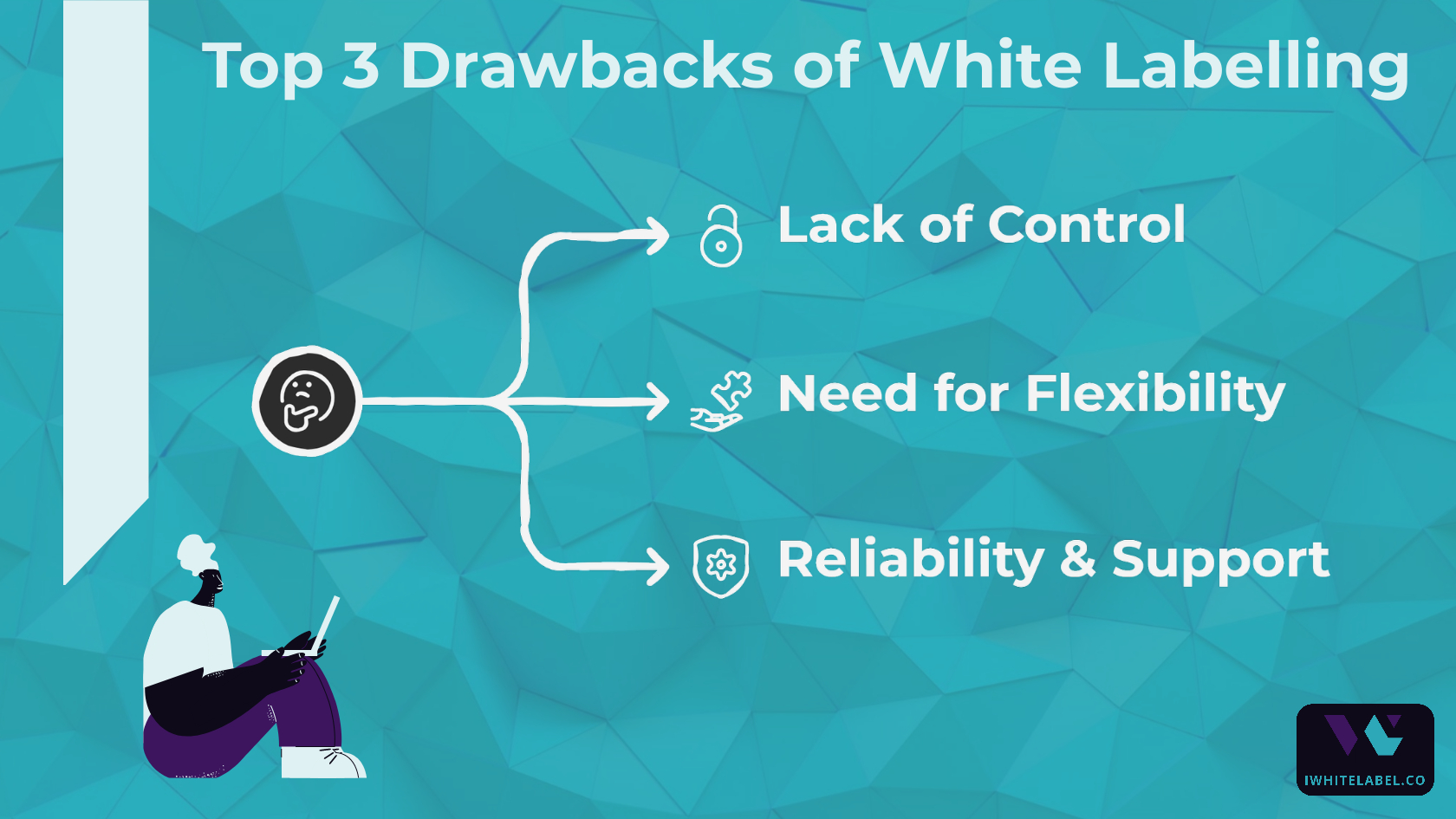

Top 3 Drawbacks of White Labelling

White labeling is a core growth play for agencies, retail businesses and entrepreneurs. Here’s how buyers evaluate providers and the specific improvements providers can make to win trust and long-term business.

1) Lack of Control

From the buyer’s seat: having control reduces risk, full stop. If a provider stumbles, work shouldn’t grind to a halt.

What buyers look for (and why it matters):

-

Self-hosting options: gives operational control when needed

-

Open-source fallback guarantee: “If discontinued, the source code will be released under an open-source license,” so the app can be maintained on the buyer's self-hosted environment.

-

Clear data and intellectual property ownership rights: covers both app design (branding, configurations), software and all user-uploaded data—no ambiguity at offboarding.

-

Community-driven roadmap: priorities shaped by customer demand and revenue contribution. This signals the product is built for real needs, not internal whims.

-

Light-touch financial transparency: brief monthly updates that show momentum and confidence.

Fast checklist for providers:

-

Offer self-hosting or clearly state when it’s available and how

-

Add an open-source discontinuation clause buyers can cite

-

Put “you own your data” in plain language (plus export steps)

-

Make roadmap voting visible and tie it to customer demand

2) Need for Flexibility (Buyer’s Job, Provider’s Enabler)

Buyers must stand out with their own positioning, packaging, and services. Providers can’t do this for them but they can enable it by offering flexible building blocks instead of rigid, one-size-fits-all flows.

What buyers test for:

-

Branding depth: email branding, numerous themes and templates, ability to rebrand knowledge bases, reports and have white label mobile apps —not just configurable logos and icons, custom domain, favicon and colour configurations

-

Workflow control: no-code/low-code builders, field-level configuration with custom additions, granular role/permission models

-

Integration readiness: robust APIs, webhooks, and multiple native integrations to popular third-party tools

-

Data freedom: import/export, report builders, and schema flexibility

-

Global readiness: localization (i18n), time zones, currency settings and support local payment methods to cater to customers in Europe, Asia, and North America.

Fast checklist for providers:

-

Demo real customization and use cases (workflows, fields, roles)

-

Progressive disclosure UI/UX approach: high flexibility can lead to a complex solution so it's important to adopt an approach where all customization options are not exposed upfront, therefore surface advanced features only when relevant to what the user is doing for a quicker adoption

-

Ship stable APIs, webhooks, and clear, up to date version docs

-

Provide data and competitor migration tools, import/export and flexible reporting out of the box

-

Support localization: language translation, date, currency

3) Reliability & Support that Actually Supports

Buyers judge providers by how they handle ordinary problems on ordinary days. No drama, just reliable service and clear communication.

What buyers verify:

-

Public status page: real-time uptime, response times, incident history, and postmortems. Trust grows when your health status isn’t hidden.

-

Multichannel support: chat, email, phone, and an active online community: different issues need different lanes

-

Brandable support assets: docs, checklists, troubleshooting scripts buyers can share under their brand

-

“On behalf” support option: the provider can interact (when authorized) as the reseller’s support arm for complex cases

-

Updates that are bug-free and don't break existing functionality

-

Social and community signals: fast, respectful engagement; issues resolved, not deflected

Fast checklist for providers:

-

Publish live status and honest incident reports

-

Offer chat/email/phone plus a moderated community forum

-

Provide white-label support kits (articles, videos, scripts) for end clients

-

Offer an add-on for “on behalf” support under reseller brand

-

Measure and share response/resolve times and what’s improving such as MRR or customer success stories

One-Glance Summary

| Challenge | What buyers check | Provider hint to improve |

|---|---|---|

| Dependency & Control | Self-hosting, open-source fallback, data ownership, transparent uptime status, community roadmap | Offer self-host + open-source clause, plain-language data ownership, roadmap voting |

| Flexibility | Branding and customization depth, workflow control, APIs/webhooks, data freedom, localization | Show real config depth, stable APIs, import/export, reporting, i18n, native integrations, progressive disclosure |

| Support & Reliability | SLAs, multichannel support, brandable docs, “on behalf” support, a stable, safe and bug-free environment | Publish SLAs/uptime/postmortems, expand channels, ship white-label support kits, offer “on behalf” option |

Bottom line: buyers want control, clarity, and confidence. Providers that enable these three without overpromising or overcomplicating win the deal.

Understanding White Label Buyer Types and Their Unique Interests

Different audience types approach white labeling with distinct motivations and requirements. Here's how each buyer type uses digital white label solutions and what providers should know to serve them effectively.

1. Agencies (Marketing, Digital, Creative)

Primary interest: Reselling branded solutions to expand service offerings without hiring specialists.

What they want:

-

Revenue expansion: Add new services like SEO tools, email marketing, or CRM under their brand for recurring income

-

Client retention: Bundle white label tools with existing services to increase client lifetime value

-

Scalability: Handle more clients without proportional staff increases

-

Co-branded assets: Marketing materials, case studies, and support docs they can share as their own

Key considerations: Agencies need deep customization for client-facing interfaces and strong partner support since they're managing multiple end-client relationships.

2. Entrepreneurs & Startups

Primary interest: Building SaaS businesses quickly without massive development investment.

What they want:

-

Speed to market: Launch in weeks, not months, to capture market opportunities

-

Lower startup costs: Avoid hiring full development teams while testing product-market fit

-

White label SDKs: Ready-to-integrate development kits for mobile apps, payment processing, or analytics

-

Full ownership feel: Complete branding control so the solution appears genuinely proprietary

Key considerations: Startups often need flexible pricing models, a short time to market and may require more hand-holding during initial setup therefore clear support documentation and onboarding is important.

3. Enterprises & Corporates

Primary interest: Self-hosting capabilities and internal branding for compliance and control.

What they want:

-

Data sovereignty: On-premises or private cloud deployment to meet regulatory requirements

-

API-first architecture: Deep integration capabilities with existing enterprise systems

-

Advanced customization: Workflow builders, role management, and configurable business logic

-

Compliance certifications: SOC 2, GDPR, HIPAA, or industry-specific standards built-in

-

White label integration platforms: Embed connectivity features directly into their existing software stack

Key considerations: Enterprises have resources for complex implementations but demand robust SLAs, dedicated support, and extensive documentation.

4. Consultants & Freelancers

Primary interest: White labeling services to appear larger and offer comprehensive solutions.

What they want:

-

Credibility boost: Present as a full-service provider rather than a solo operator

-

Service expansion: Offer no-code technical solutions (web development, marketing automation) without learning new skills

-

Consistent income streams: Predictable revenue through reselling arrangements alongside project work

-

Minimal overhead: Solutions that don't require significant upfront investment or ongoing management

Key considerations: Freelancers need simple pay per use pricing, easy onboarding, and the ability to start small and scale gradually as their client base grows.

5. Retail Businesses (B2C Focus)

Primary interest: Branded products for direct consumer sales, not reselling.

What they want:

-

Product diversification: Expand catalog without manufacturing investment

-

E-commerce platforms: White label online stores with payment processing, inventory management, and customer support

-

Brand differentiation: Unique packaging, labeling, and customer experience to compete with established brands

-

Quality assurance: Reliable suppliers who maintain consistent product standards

-

B2C white label solutions: Consumer-facing tools like customer loyalty programs, mobile apps, or customer service platforms

Key considerations: Retailers focus on end-consumer experience and may need help with marketing, not just technology.

6. IT & Technology Service Providers (MSPs, ISVs)

Primary interest: Integrating complementary tools into their existing technology stack.

What they want:

-

Stack completion: Add missing capabilities (monitoring, security, backup) without building from scratch

-

White label hosting solutions: Email, web hosting, or cloud services under their brand

-

API and SDK access: Deep integration capabilities to embed functionality seamlessly

-

Technical partnership: Providers who understand their existing architecture and integration challenges

-

Revenue diversification: New service lines that complement their core offerings

Key considerations: Tech providers need robust APIs, comprehensive documentation, and the ability to customize workflows to match their existing service delivery processes.

Understanding these distinct motivations helps providers tailor their white label offerings, pricing, and support models to attract and retain different buyer segments effectively.

The White Label Profit Engine

White labeling isn't just another business model—it's the fastest path to predictable profits with margins that put most industries to shame. With 83% average gross margins in SaaS white labeling and resellers consistently achieving 40-60% margins across categories, this industry offers profit potential that traditional businesses can only dream about.

Horizontal White Label Categories: Cross-Industry Profit Engines

Research shows these solutions dominate white label adoption because they solve universal business problems while delivering exceptional profit margins for resellers.

| Category | White Label Market Potential | Key Performance Insights | Primary Buyer Types |

|---|---|---|---|

| CRM & Sales | Large and growing demand across industries, especially SMBs | Agencies report faster client onboarding and increased retention | Agencies (client management), Entrepreneurs (SaaS building), IT Providers (stack completion) |

| Marketing | High adoption for multi-channel campaigns | Improves campaign efficiency and measurable ROI for clients | Agencies (service expansion), Entrepreneurs (marketing SaaS), Consultants (credibility boost) |

| Customer Experience & AI Chatbots | Increasing use in service industries | Reduces response times and improves customer satisfaction | Agencies (client services), Enterprises (internal support), IT Providers (managed services) |

| Analytics & Reporting | Growing need for data-driven insights | Enhances client reporting quality and supports premium pricing | Agencies (client reporting), Consultants (data presentation), Enterprises (business intelligence) |

| Cybersecurity | High demand due to regulatory requirements | Improves client retention, compliance, and perceived value | IT Providers (MSP services), Enterprises (data sovereignty), Agencies (client security) |

Vertical White Label Categories: Industry-Specific Goldmines

Vertical solutions command higher margins because they embed compliance, specialized workflows, and industry expertise that generic tools can't replicate.

| Vertical | Key Use Cases | Competitive Advantages | Primary Buyer Types |

|---|---|---|---|

| Healthcare | Virtual assistants, patient risk scoring, appointment management | Supports HIPAA compliance, improves operational efficiency, enhances patient experience | Enterprises (hospitals/clinics), IT Providers (healthcare tech), Specialized Agencies |

| Financial Services (FinTech) | Fraud detection, automated compliance reporting, payment processing | Meets regulatory requirements, increases trust, streamlines operations | Enterprises (banks/fintech), IT Providers (fintech solutions), Consultants (compliance services) |

| E-commerce | Recommendation engines, real-time personalization, inventory optimization | Improves conversion, enhances customer experience, scalable across online stores | Retail Businesses (direct sales), Agencies (e-comm clients), Entrepreneurs (online stores) |

| Real Estate | Automated lead qualification, market analysis tools, transaction management | Enables premium service delivery, improves deal management efficiency | Agencies (real estate marketing), Entrepreneurs, IT Providers |

| Legal | Contract analysis via AI, document automation, case research | Reduces overhead, increases accuracy, accelerates workflows | Enterprises (law firms), IT Providers (legal tech), Consultants (process optimization) |

Buyer Type Insights:

-

Agencies dominate horizontal solutions (73% of demand) due to service expansion needs

-

Enterprises lead vertical adoption for compliance-heavy industries (healthcare, finance, legal)

-

IT Providers excel across both categories when technical integration is required

-

Entrepreneurs focus on rapid market entry with e-commerce and SaaS-friendly verticals

-

Retail Businesses concentrate on direct consumer applications, particularly e-commerce platforms

Frequently Asked Questions (FAQs)

White labeling allows businesses to sell white label products developed by a white label manufacturer under their own brand name. This approach provides a competitive advantage by enabling rapid time to market for a new product while leveraging proven solutions. Companies maintain control over branding, pricing, and customer relationships while accessing high-quality products without investing heavily in product development. Using white label products allows businesses to expand their product lines and meet market demand efficiently.

White label products shorten the time to market from typical six to eighteen-month development cycles to just days or weeks. Businesses can leverage white label solutions to respond to market opportunities quickly and deliver a product or service that appears proprietary to customers. The approach combines the advantages of a proven product with customizable branding and select features, enabling companies to expand their product lines and maintain competitive positioning in fast-moving industries.

White label software provides multiple advantages compared to building in-house. Businesses save on development costs while leveraging high-quality products and proven technology. Using white label products enables faster market entry, allows teams to focus on core sales growth activities. Customizable features and branding let companies differentiate while still offering a consistent and professional product or service.

Agencies and service providers lead the adoption of white label products for marketing expansion. They utilize white label software to add new service lines such as CRM, analytics, and customer support under their own brand. Entrepreneurs and startups leverage these solutions to bring new products to market quickly. By using white label products, agencies maintain client relationships, scale services efficiently, and expand their product lines without proportional increases in staff.

When choosing a white label provider, businesses should focus on finding a partner that allows full branding control, responsive support, reliable uptime, and healthy margins. It is also important to evaluate costs, setup time, compliance, and customization options while ensuring the solution meets real client needs and can be delivered confidently. Selecting the right provider lets businesses leverage white label products to expand their product lines, maintain high-quality offerings, and scale efficiently without heavy product development.

White label businesses often achieve high profitability and resellers across categories can expect 40% to 60% margins. AI-enhanced white label software can further increase returns, with some agencies generating significant monthly recurring revenue in early quarters. Profitability stems from leveraging white label solutions, recurring revenue models, low marginal costs, and the ability to serve multiple clients using a single platform investment.

Common challenges include limited control, dependency on support, and flexibility constraints. Businesses can address these challenges by selecting a white label manufacturer that offers deep customizable software capabilities, self-hosting options, and clear data ownership. Thorough evaluation of the provider’s product development roadmap, support quality, and commitment to partner success ensures resellers can leverage white label solutions effectively while mitigating common risks.

AI transforms white label software by enabling faster growth and advanced features such as predictive analytics, automated support, and personalized user experiences. Using white label products with AI capabilities allows resellers to deliver high-quality products and command premium pricing. Healthcare and e-commerce providers, for example, benefit from faster response times and automated inquiry handling, demonstrating the tangible advantages of combining proven products with AI.

Customizable branding in white label software goes far beyond logos, colors, and domains to include elements such as email configuration with your own SMTP, favicons, mobile apps, dashboards, reporting templates, knowledge bases, and fully white-labeled backend and admin sections. Leveraging white label solutions with this level of branding allows businesses to present a truly proprietary product or service, reduce client bypass risk, strengthen brand loyalty, and justify premium pricing. Deep customization also enables businesses to expand their product lines and deliver high-quality products under their own label while maintaining a distinctive, professional experience for both end users and administrators.

White label solutions accelerate business growth by providing access to proven technology without heavy product development investment. Businesses can leverage white label products to deploy new features quickly, experiment in new markets, and focus on customer success. Combining a proven product with unique service delivery creates a competitive advantage that is difficult for competitors to replicate. Using white label products strategically supports growth, market expansion, and long-term business sustainability.

Conclusion

White label and private label strategies give businesses the ability to move fast, scale smart, and deliver high-quality products without starting from scratch. By working with the right white label supplier or manufacturer, companies can leverage proven products, expand their product lines, and focus on customer relationships instead of heavy product development. Whether it is software, physical goods, or digital assets, the advantage of white labeling lies in combining speed, flexibility, and product quality to create enduring value. The future of white labeling belongs to brands that treat it not as a shortcut, but as a strategic path to growth.